parktaxi72.ru Market

Market

Register Multiple Social Media Accounts

Later's social media scheduling and management software, influencer marketing platform, and link in bio tool help you reach new customers and build your. When adding your accounts to the U.S. Digital Registry, you must include: “Department of the Interior (DOI)” along with your bureau in the agency section. Use the social media scheduler to publish posts across multiple accounts and channels. Plan, organize, and schedule posts for consistent publishing. 29 votes, 12 comments. I need to find out someone's social media accounts by their email. How do I do this? I tried beenverified before. Create and schedule social media content within minutes, seamlessly collaborate with your team or clients, and easily track your success with Loomly. Key takeaways: · Include a name and describe your business on your Facebook and Instagram accounts. · Add an image or photo to help people recognize your business. Manage social media for multiple clients? Create categories to group accounts together, then organize and filter posts by those categories. You can create as. Click Add an existing account and sign into that account. How to Switch Accounts. multiple accounts. After you've set up your second account, it's time to. Click Add an existing account and sign into that account. How to Switch Accounts. multiple accounts. After you've set up your second account, it's time to. Later's social media scheduling and management software, influencer marketing platform, and link in bio tool help you reach new customers and build your. When adding your accounts to the U.S. Digital Registry, you must include: “Department of the Interior (DOI)” along with your bureau in the agency section. Use the social media scheduler to publish posts across multiple accounts and channels. Plan, organize, and schedule posts for consistent publishing. 29 votes, 12 comments. I need to find out someone's social media accounts by their email. How do I do this? I tried beenverified before. Create and schedule social media content within minutes, seamlessly collaborate with your team or clients, and easily track your success with Loomly. Key takeaways: · Include a name and describe your business on your Facebook and Instagram accounts. · Add an image or photo to help people recognize your business. Manage social media for multiple clients? Create categories to group accounts together, then organize and filter posts by those categories. You can create as. Click Add an existing account and sign into that account. How to Switch Accounts. multiple accounts. After you've set up your second account, it's time to. Click Add an existing account and sign into that account. How to Switch Accounts. multiple accounts. After you've set up your second account, it's time to.

Publish content from your own blogs and sites Keep an eye out for updates from your website, blog or online shops and create quick, beautiful posts for every. 1. Establish your purpose for each account · What is the goal? Decide why you or your brand need to create multiple accounts, to better understand the final goal. users' social network such as Facebook, Google, Twitter and so on. 2) When you sign-up through social account, websites always ask you type of data they. Multiple User Accounts. Our Business Plan is perfect for platforms, products, agencies, consulting firms, and. Creators can manage multiple Facebook Pages and Instagram accounts together in Meta Business Suite. Manage multiple Facebook Pages and Instagram accounts at. Create amazing Social Media Feeds from unlimited combinations of multiple sources: Instagram, Facebook, YouTube, TikTok, Twitter, Pinterest, Tumblr, RSS. Later's social media scheduling and management software, influencer marketing platform, and link in bio tool help you reach new customers and build your. Social media marketing Amplify the conversation across multiple channels Only franchises and agencies can create multiple accounts under our Acceptable. Elevate your brand story on social media. Collaborate with your clients and teams to plan, post, and measure the success of content on every platform. Schedule your social media content with ease, from one place, for all your profiles. day free trial, no credit card required. Social Media Management, Simplified · Discover relevant content based on your topics of interest · Publish content from your own blogs and sites · Pre-schedule all. The easiest way to manage your brands on social media. Schedule unlimited posts, monitor what matters, and create custom-reports to analyze your social. Create and collaborate visually in the classroom. Students. Designs and How to connect your social media account to Canva. How to schedule a post. If you want to register several social media accounts with one email, use a Gmail account. Gmail is the only emailing service that permits the registration of. Manage jaw-dropping & scroll-stopping social media feeds. Create, recycle, schedule, publish, analyze, engage, collaborate, and approve your social media posts. How to Set Up Social Media Profiles · Step 1 — Create Your Account · Step 2 — Choose a Profile Photo and Banner Image · Step 3 — Write a Compelling Profile. Social media is a powerful tool that helps to build brand awareness, raise visibility, and encourage conversation. Recognize that starting an account is a. Save time scheduling, analyzing, and managing your social media and ad content. Create your FREE account and grow your business presence. Create, publish, and easily manage your social media content at scale with FeedHive's AI-powered platform.

Search Crypto Wallet Address

From the parktaxi72.ru Wallet app's home screen, tap on the "Funds" icon in the bottom toolbar. · Select the blockchain of the transaction you are looking for. To view the contents of all transactions for a specific crypto address, select the WALLET option and enter the crypto wallet address in the search field. WALLET. Check Bitcoin addresses, lookup transactions. Monitor wallet balances using xpub with our block explorer. No signup required, free to use! Blockstream Explorer is an open source block explorer providing detailed blockchain data across Bitcoin, Testnet, and Liquid. Before you use your crypto address · Sign in to your Coinbase account. · Go to Crypto addresses. This can also be accessed by selecting your profile icon, then. Explore any blockchain for transactions, addresses All transactions, miners, and wallets at your fingertips: search the blockchain data with GetBlock explorer. Blockchain explorer, analytics and web services. Explore data stored on 42 blockchains. Search addresses, transactions and blocks. Search. Search examples. Use the Custom Search engine feature to lookup tokens, addresses, names, tags and more;. Features on Ethplorer include the ability to: Tag and note any. Real-time blockchain data. With the BTC block explorer, you can search blocks, addresses, and transactions on the Bitcoin blockchain. From the parktaxi72.ru Wallet app's home screen, tap on the "Funds" icon in the bottom toolbar. · Select the blockchain of the transaction you are looking for. To view the contents of all transactions for a specific crypto address, select the WALLET option and enter the crypto wallet address in the search field. WALLET. Check Bitcoin addresses, lookup transactions. Monitor wallet balances using xpub with our block explorer. No signup required, free to use! Blockstream Explorer is an open source block explorer providing detailed blockchain data across Bitcoin, Testnet, and Liquid. Before you use your crypto address · Sign in to your Coinbase account. · Go to Crypto addresses. This can also be accessed by selecting your profile icon, then. Explore any blockchain for transactions, addresses All transactions, miners, and wallets at your fingertips: search the blockchain data with GetBlock explorer. Blockchain explorer, analytics and web services. Explore data stored on 42 blockchains. Search addresses, transactions and blocks. Search. Search examples. Use the Custom Search engine feature to lookup tokens, addresses, names, tags and more;. Features on Ethplorer include the ability to: Tag and note any. Real-time blockchain data. With the BTC block explorer, you can search blocks, addresses, and transactions on the Bitcoin blockchain.

The most popular and trusted Bitcoin block explorer and crypto transaction search engine.

It allows anyone to explore current and historical data related to transactions, addresses, blocks, and more. Blockchains, such as those of Bitcoin and Ethereum. Bitcoin Address Lookup Search and Alerts. View and research bitcoin ownership, transactions and balance checker by name, bitcoin address, url or keyword. Step 1. Head to EthVM. ; Step 2. In the search bar, enter your Ethereum public address, (0x..). ; Step 3. You will be taken to a wallet overview. Simply enter the address you would like to check, we then look up an updated version of the blockchain. In this check we find out the amount held in the wallet. Etherscan allows you to explore and search the Ethereum blockchain for transactions, addresses, tokens, prices and other activities taking place on Ethereum . The transaction ID can be used to find a transaction in a blockchain explorer. Transaction IDs can be viewed in Trezor Suite by simply clicking on a particular. A bitcoin wallet address lookup is a unique alphanumeric string of characters, such as 26 to 35 characters in length. These public addresses in Bitcoin form the. You can find your unique crypto wallet addresses on web or the Coinbase mobile app. You can also use your unique wallet addresses to find your transaction hash. Go to any blockchain explorer site of your choice to kick off the investigation. · Input the Bitcoin address you want to investigate into the search bar. · Next. A blockchain explorer is a free search engine (like Google) that lets you search and view cryptocurrency transactions, including wallet addresses, the times of. Bitcoin block explorer with address grouping and wallet labeling. Enter address, txid, firstbits (first address characters), first txid characters. To look up a specific wallet address on a block explorer, simply copy and paste the address from your wallet app or the 1inch dApp interface, into the search. The most popular and trusted block explorer and crypto transaction search engine parktaxi72.ru: Crypto Wallet. Blockchain. Get the App. View · Transactions. To locate a transaction hash/hash ID, there are a few options available to you. If you have a cryptocurrency wallet, you can check it for the transaction hash. The crypto wallet addresses can be found on the Wallet page (website) and Wallet tab in the parktaxi72.ru App. The tokenview blockchain explorer is the blockchain search engine enables to lookup transaction data, wallet address, blockchain news and blockchain api. To generate a wallet address for a supported cryptocurrency: 1. Login to your Kriptomat account. 2. Locate the My Wallets section. 3. Click the cryptocurrency. How do I find my wallet address? On Zengo, simply tap the main menu in the center of the screen, then "Receive," and then choose the blockchain /coin you want. Your transaction ID is shown in both the URL of the page and in a box at the top right of screen titled Transaction hash. Where do I find my Bitcoin address? A Bitcoin address alone is not traceable. There's no personal information stored on the blockchain, nor will you find any in blockchain explorers. However.

Can You Transfer An Ira To Another Person

The process of moving existing retirement funds from one plan to another is referred to either as a rollover or transfer. There are specific IRS rules that. Three easy steps to transfer your accounts. · Step. 1. Enter account information. All you need is the name of the firm holding your account(s) and your account. You could use it up to your normal contribution limit, assuming you otherwise could make normal contributions to an IRA. Besides that, no. How do I roll over funds from my current TIAA employer-sponsored retirement plan account to a new Investment Solutions IRA? Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. IRA transfers involve the same type of retirement plan moving from one firm to another. For example: moving a traditional IRA from ABC Bank to a traditional IRA. You can also have your financial institution or plan directly transfer the payment to another plan or IRA. The rollover chart PDF summarizes allowable rollover. Consider consolidating your multiple Individual Retirement Accounts (IRAs) into one account to reduce investment fees and maximize your returns. The short answer is yes if you inherit the IRA from a spouse. But a rollover to your own IRA is not allowed if you inherit the IRA from anyone else. The process of moving existing retirement funds from one plan to another is referred to either as a rollover or transfer. There are specific IRS rules that. Three easy steps to transfer your accounts. · Step. 1. Enter account information. All you need is the name of the firm holding your account(s) and your account. You could use it up to your normal contribution limit, assuming you otherwise could make normal contributions to an IRA. Besides that, no. How do I roll over funds from my current TIAA employer-sponsored retirement plan account to a new Investment Solutions IRA? Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. IRA transfers involve the same type of retirement plan moving from one firm to another. For example: moving a traditional IRA from ABC Bank to a traditional IRA. You can also have your financial institution or plan directly transfer the payment to another plan or IRA. The rollover chart PDF summarizes allowable rollover. Consider consolidating your multiple Individual Retirement Accounts (IRAs) into one account to reduce investment fees and maximize your returns. The short answer is yes if you inherit the IRA from a spouse. But a rollover to your own IRA is not allowed if you inherit the IRA from anyone else.

IRAs are designed to be the property of the owner and can't be transferred to another person except under two circumstances. The only way to move those funds from one custodian to another is a trustee-to-trustee transfer. The funds move directly from one custodian to the other. If you previously were a member of the New York State and Local Retirement System (NYSLRS), or another public retirement system in New York State, your service. A transfer of assets (TOA) is when you transfer all or part of an account from one financial firm to another without selling your holdings. You can transfer a Roth IRA from one custodian to another without taxes and penalties if you follow some simple rules. IRA transfers involve the same type of retirement plan moving from one firm to another. For example: moving a traditional IRA from ABC Bank to a traditional IRA. Can the bank charge for transferring my individual retirement account (IRA) to another institution? Yes. The bank makes these decisions. Federal law does not. A transfer is moving money from one account into another. At Vanguard, you can do 2 types of transfers: External transfers: Asset movements between an IRA. Open an IRA account with your new bank, fill out a transfer instruction form, then allow 3 to 5 business days to complete the transfer. If you're converting a. There are no limits on the number of transfers you can do between retirement accounts. A transfer of assets is not a tax-reportable event because the assets are. However, during the 2-year period beginning when you first participated in your employer's SIMPLE IRA plan, you can only transfer money to another SIMPLE IRA. With the inherited IRA retitled accordingly (treating it as “your own”), the surviving spouse is able to make a trustee-to-trustee transfer by moving a current. If you inherit your spouse's traditional IRA, you can assume ownership of the IRA by a spousal transfer. You can treat the IRA as if it was your own. Most commonly, those who inherit an IRA from a spouse transfer the funds to their own IRA. Note: If the original account holder did not take an RMD in the year. In either case, the registration type of both IRAs must match in order to transfer the assets from one account to another (e.g., traditional IRA to traditional. A person can complete a transfer if he or she holds an IRA at another financial institution and would like to move to an Equity Trust account. Yes, you can transfer a Custodial IRA to Schwab from another institution. If I am the custodian. Transfer an existing brokerage account, IRA account, or securities from another financial institution. You can also transfer securities instantly between your. When an IRA owner dies, the assets held in their account generally must be transferred into a new IRA in the beneficiary's name. This becomes an inherited IRA. The funds are transferred directly from one spouse's IRA to the other spouse's IRA. Dividing or transferring IRA funds without following these rules could mean.

Visa Crypto Currency

Regardless of the volatility of cryptocurrencies, the market and consumers remain attentive to trends for this digital currency. Visa is working to combine. Rest easy. Your money's safe Freeze and unfreeze your card instantly. Generate digital cards for extra peace of mind. Get notifications for every transaction. All cryptocurrency will be converted to the respective market's currency and can be loaded onto the parktaxi72.ru Visa Card for use in purchase and ATM withdrawals. As of , we estimated global cryptocurrency ownership at an average of %, with over million crypto owners worldwide. Over + Million Cryptocurrency. Today, customers using traditional debit and credit cards must sell their cryptocurrency in exchange for fiat and transfer funds to their bank accounts. green-. The TenX crypto debit card enables you to spend Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) immediately at ATMs, merchant stores, and other stores that. Visa Direct can drive more funding and trading activity between owners and their cryptocurrency exchanges, especially among younger owners. Cryptocurrencies are currencies such as Bitcoin and Ether that are unaffiliated with any government or central bank. Stablecoins are backed by a reserve asset . 1 billion US worth of cryptocurrency was spent by consumers globally on goods and services through crypto-linked Visa credit cards during the first six months. Regardless of the volatility of cryptocurrencies, the market and consumers remain attentive to trends for this digital currency. Visa is working to combine. Rest easy. Your money's safe Freeze and unfreeze your card instantly. Generate digital cards for extra peace of mind. Get notifications for every transaction. All cryptocurrency will be converted to the respective market's currency and can be loaded onto the parktaxi72.ru Visa Card for use in purchase and ATM withdrawals. As of , we estimated global cryptocurrency ownership at an average of %, with over million crypto owners worldwide. Over + Million Cryptocurrency. Today, customers using traditional debit and credit cards must sell their cryptocurrency in exchange for fiat and transfer funds to their bank accounts. green-. The TenX crypto debit card enables you to spend Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) immediately at ATMs, merchant stores, and other stores that. Visa Direct can drive more funding and trading activity between owners and their cryptocurrency exchanges, especially among younger owners. Cryptocurrencies are currencies such as Bitcoin and Ether that are unaffiliated with any government or central bank. Stablecoins are backed by a reserve asset . 1 billion US worth of cryptocurrency was spent by consumers globally on goods and services through crypto-linked Visa credit cards during the first six months.

Cryptocurrencies. Exchange in a few seconds your cryptos for euros and spend them paying online or in physical stores. Crypto visa cards are Visa debit cards issued by crypto companies like binance, parktaxi72.ru or coinbase. These cards can be topped up with fiat. Manage your cryptocurrency portfolio with BitPay's secure, open-source, non-custodial cryptocurrency wallet. A crypto automated teller machine (ATM), also called a Bitcoin ATM, is a machine that allows you to insert cash in exchange for cryptocurrencies. In some cases. Collaborate with Visa's Digital Currency Innovation Hub to learn crypto and evaluate and develop new digital currency experiences. Visa's announcement comes after a year of institutional and other traditional investors finally coming aboard the crypto as a digital currency bandwagon, buoyed. What can I do after I buy cryptocurrency? Buy your favorite coins and watch your assets grow. $10, worth of Bitcoin from is worth over $1 million in. For instance, a user can travel to another country without worrying about obtaining foreign currency ahead of time, as the same Visa card allows you to make. Crypto visa cards are Visa debit cards issued by crypto companies like binance, parktaxi72.ru or coinbase. These cards can be topped up with fiat. Visa has partnered with about 60 leading crypto platforms to "make it easy for consumers to convert and spend digital currency.". US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. In this paper, Visa Consulting & Analytics. (VCA) introduces digital currencies, considers the opportunities and the vulnerabilities for financial institutions. For instance, a user can travel to another country without worrying about obtaining foreign currency ahead of time, as the same Visa card allows you to make. But here's the basic premise: your Visa debit card can now be swiped at checkout and spend any cryptocurrency at the point of sale. Speak to sales. Speak to. My Prepaid Center VISA Gift Card · Tether (USDT) · Bitcoin (BTC) · Ethereum (ETH) · Litecoin (LTC) · TRON (TRX) · Solana (SOL) · Monero (XMR) · Binance Coin (BNB). Crypto platforms will become more integrated into the existing payments ecosystem as they begin to embed Visa credentials into their wallets, enabling consumers. Introducing our latest feature, Sell-to-Card, which enables users to effortlessly and instantly trade cryptocurrencies for your preferred fiat currency and have. Scale your payments globally with near instant, low-cost payments on payment rails that connect digital assets to the traditional financial system. Explore Bulk. Crypto debit cards · parktaxi72.ru Visa Debit Card: You'll earn rewards in CRO, parktaxi72.ru's own cryptocurrency. · Coinbase Debit Card: You can choose to earn. Blockchain jobs at Visa. Product Marketing Analyst, Fintech & Crypto Products in Foster City CA. Senior Analyst, Visa Crypto Solutions in San Francisco CA.

How Far Back Do Mortgage Lenders Look At Credit History

When considering your financial history, mortgage lenders typically look back at the past two to three years on a bank statement. For credit history, they may. Do you pay your bills on time? If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and. Mortgage lenders look at your credit history for at least the past two years. They may look at credit history data that is quite a bit older, too. The further back your good credit goes, the better your response from mortgage lenders is going to be. This is pretty self-explanatory: a long history of a good. Can lenders see that I have gambled on my bank statements? Yes, when you apply for a mortgage lenders will want to look at your bank statements from the past 3. Credit information submitted by lenders in respect of new loan applications is held on the Central Credit Register for a period of 6 months from the date on. How far back do mortgage lenders look? Mortgage lenders will usually assess the last six years of your credit history. Your credit report contains information. If the second credit check results match the first, closing should occur on schedule. If the new report is lower or concerning to the lender, you could lose the. Information remains on annual credit reports as follows: inquiries – 2 years, late payments – 7 years, paid tax liens – 7 years, unpaid tax liens – 15 years. When considering your financial history, mortgage lenders typically look back at the past two to three years on a bank statement. For credit history, they may. Do you pay your bills on time? If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and. Mortgage lenders look at your credit history for at least the past two years. They may look at credit history data that is quite a bit older, too. The further back your good credit goes, the better your response from mortgage lenders is going to be. This is pretty self-explanatory: a long history of a good. Can lenders see that I have gambled on my bank statements? Yes, when you apply for a mortgage lenders will want to look at your bank statements from the past 3. Credit information submitted by lenders in respect of new loan applications is held on the Central Credit Register for a period of 6 months from the date on. How far back do mortgage lenders look? Mortgage lenders will usually assess the last six years of your credit history. Your credit report contains information. If the second credit check results match the first, closing should occur on schedule. If the new report is lower or concerning to the lender, you could lose the. Information remains on annual credit reports as follows: inquiries – 2 years, late payments – 7 years, paid tax liens – 7 years, unpaid tax liens – 15 years.

If the second credit check results match the first, closing should occur on schedule. If the new report is lower or concerning to the lender, you could lose the. How Far Back Do Lenders Look? Mortgage lenders typically scrutinize the last two months of your bank statements. This comprehensive review includes all. Do you pay your bills on time? If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and. What mortgage lenders look for on your bank statements · Income variation. · Savings. Lenders need to know if you have the savings to cover not only a down. They are lenders who go as far as 3 years to see if you are consistent with your finances and if you have good financial management history. The short answer is lenders want to see your track record with credit. And it's a good way for you to see your progress (and pat yourself on the back). See my. Q. How long does a fraud alert stay on my credit file? A. The statement remains on your file for a period of 6 years from. As determined by Fannie Mae guidelines, credit reports are only good for days, so if you get pre-approved then find a home a few months later, your report. What can I do to show the lender I am reliable? During our time working in the mortgage industry, helping customers to obtain first time buyer mortgages or to. As determined by Fannie Mae guidelines, credit reports are only good for days, so if you get pre-approved then find a home a few months later, your report. Most lenders will only need two or three months of statements for your application. The main things a lender will be checking is your income, your regular bill. For this reason, lenders can (for the most part) only use the past six years of your payment history when looking at your Credit Report to assess whether you. If you are applying for a mortgage with a co-signer, like a spouse, each applicant's FICO 2, 4 and 5 scores are pulled. The lender identifies the median score. make a loan: capacity, capital, collateral and credit. Capacity to Pay Back the Loan. Lenders look at your income, employment history, savings and monthly. Lenders will evaluate your payment history to ensure you have a record of on-time payments. A strong payment history portrays you as a responsible borrower. How Far Back Do Lenders Look? Mortgage lenders typically scrutinize the last two months of your bank statements. This comprehensive review includes all. That's especially true if your score is above Credit scores of While there is no absolute minimum credit score, it does vary between lenders. If after 60 or so days, you still don't see your loan, reach out to your lender and the credit bureaus. If possible, you should avoid refinancing your mortgage. That's because there are three main credit bureaus. Which one does the lender use? The answer is your "middle score." As the name suggests, the middle score is. How Far Back Does a Mortgage Application Credit Check Go? Your credit check will review your full credit history for the last six years, including any.

How Much Should I Pay For Financial Advisor

The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. This fee is a percentage of whatever the value is of your accounts managed. For instance, if the total value of your accounts is $1 million and your advisor has. A fee for an FP is around % but usually is offset by them also having access to cheaper rate funds and you get the planning and stuff as. As for the front lines of financial advisory firms, the median total direct compensation for office managers for all firms was $, in , according to. The most common form is an annual percentage tied to the total value of the assets the advisor oversees for you. While fees range widely, 1% is typical. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in. Setting Expectations: Hourly Rates Rates can vary depending on the experience of the advisor and if the advisor has a highly valued area of expertise. The. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. A % fee for AUM is slightly higher than the 'average'. But, just because an advisor's fees are above or even below the average doesn't. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. This fee is a percentage of whatever the value is of your accounts managed. For instance, if the total value of your accounts is $1 million and your advisor has. A fee for an FP is around % but usually is offset by them also having access to cheaper rate funds and you get the planning and stuff as. As for the front lines of financial advisory firms, the median total direct compensation for office managers for all firms was $, in , according to. The most common form is an annual percentage tied to the total value of the assets the advisor oversees for you. While fees range widely, 1% is typical. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in. Setting Expectations: Hourly Rates Rates can vary depending on the experience of the advisor and if the advisor has a highly valued area of expertise. The. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. A % fee for AUM is slightly higher than the 'average'. But, just because an advisor's fees are above or even below the average doesn't.

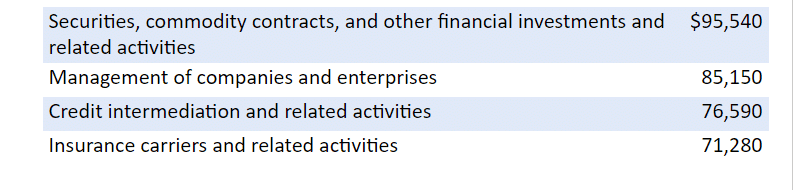

Fees can vary, but they typically start in the $1, to $2, range and can go up to $5, to $6, or more a year. The complexity of your personal. Hourly Wage, $ , $ , $ , $ ; Annual Wage (2), $ 48,, $ 65,, $ 99,, $ , The cost of a financial advisors based on their fee-model · $ to $ an hour/ $1, to $3, per plan/ % to % of AUM · 3% to 6% of the investment. Financial advisors choose from a variety of fees, including flat and hourly rates, percentages based on assets-under-management (AUM) and commission. Look for 1% and less including commissions. Start by interviewing other firms. Here are a couple questions to ask. What are your fees and how do. Some advisors charge an hourly rate ranging from $ to $ an hour or, a monthly subscription or retainer fee or flat rate, which can be paid out annually. The average pay range for a Financial Advisor varies greatly (as much as $49,), which suggests there may be many opportunities for advancement and increased. Advisors who charge a 1% annual fee typically offer asset management. If you get additional services on top of investment management services, the fee might be. Usually Financial advisors charge 1% of your Gross Portfolio value per year. And usually they guarantee a return of about 7% return on your. The average fee for the advice and planning they offer is 1%. For example, if you have $, invested with your advisor, you have likely paid $5, per year. How Much Does a Financial Advisor Make? Financial Advisors made a median salary of $95, in The best-paid 25% made $, that year, while the. Financial advisors in the United States typically make between $50, and $, per year, with the average salary being around $75, Generally, financial advisors charge a flat fee based on the services offered and the duration of the engagement, such as $xx for a month/ quarter/ year. They. Fixed Fees by Service Similar to hourly rates, a CFP® professional might charge by the service. For example, a professional might charge a fixed fee to draw. Our Fee Filter uses special software to show exactly how much you're paying in financial advisor fees, and how much you are paying for investments. The median annual wage for personal financial advisors was $99, in May The median wage is the wage at which half the workers in an occupation earned. Charges can vary depending on the type of advice you are getting. Financial advisers generally get paid by: Commission – Where a financial adviser receives. New Financial Advisor Pay ; $14, · $5,, $70, · $22, · $13, ; $11, · $3,, $66, · $18, · $8, ; $8, · $2,, $62, · $13, · $4, The average pay range for a Financial Advisor varies greatly (as much as $52,), which suggests there may be many opportunities for advancement and increased. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally.

Bills More Than Income

It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than. Falling behind on bills can lead to financial headaches. Learn what options you may have if you're unable to keep up with monthly bill payments. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. You have to either increase your income, decrease your expenses, or do a combination of the two. I'll share some ideas. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes. You must decide how much to pay to each creditor. One way is to divide the money available and pay every creditor a share of what you owe them. come from? A step further. Is your income more or less than you thought it was? Does this feel. Look to cut down on frivolous purchases and ensure that your money goes where it's needed most. 5. Watch out for debt relief scams. Agencies such as debt. It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than. Falling behind on bills can lead to financial headaches. Learn what options you may have if you're unable to keep up with monthly bill payments. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. You have to either increase your income, decrease your expenses, or do a combination of the two. I'll share some ideas. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes. You must decide how much to pay to each creditor. One way is to divide the money available and pay every creditor a share of what you owe them. come from? A step further. Is your income more or less than you thought it was? Does this feel. Look to cut down on frivolous purchases and ensure that your money goes where it's needed most. 5. Watch out for debt relief scams. Agencies such as debt.

You should speak to the organisations you owe money to – they might let you pay smaller amounts or take a break from payments. Don't ignore bills or letters. Cutting expenses is quicker and often easier than increasing income. Still, many people think increasing income is a less painful option. If you plan to. Automate your bills. As much as possible, try to get your bills to be paid through automatic deduction. For those that can't, use your bank's online check. If you save less than 5% of your gross income, you're probably in over your head. If you're spending more than you earn, you're definitely in over your head. Does there seem to be more month than money? Here are some helpful tips for tackling debt when your bills exceed your income. It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. If you're behind on your bills, don't wait to call the creditors you owe money to. Do it before a debt collector gets involved. Tell your creditors what's going. In this scenario, it's better to ask permission rather than forgiveness. Many service providers —utilities, mobile/wireless carriers and other necessities — are. LIHEAP Income Eligibility *For families/households with more than 10 persons, add $8 for each additional person. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. This is simple, but very hard to deal with. My expenses would always exceed my income if I didn't make concessions. You have a deficit budget if the money you need to spend each month on living costs is higher than the money you receive each month from work and benefits. Whether it be a recession, drop in income or an unforeseen payment, you may have less money than before — which can make paying your bills and expenses. Rent, utility bills, student loans, food, and even the cost of commuting to and from your job every day is expensive, to say the least. However, when the cost. 1. See Where You Stand. One of the reasons that you feel overwhelmed when you have more bills than income is that you aren't in control of the situation. After putting off payment for a few months, these bills will start to have more lasting impacts on your financial health down the road, like foreclosure and. The amount of the “deductible” is called the “spenddown amount.” When you have collected medical bills (paid or unpaid) greater than your excess income, you. “You might be more motivated to invest your disposable income than pay off your mortgage or student loan debt,” says Leslie Tayne, a debt-relief attorney at. Stress your interest in paying off the debt and ask about options. Remember, most companies have no more desire to lose a customer than you do to avoid your. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than.

Schwab Premarket Hours

Orders can be placed at any time. Pre-Market Trading. Individual investor orders may be executed from a.m. to a.m. ET. Orders can. Hours As TD Bank Cuts Stake Following $B Anti-Money Laundering Fine Provision. Charles Schwab Corporation SCHW shares fell by over 4% in after-hours after. At Schwab, orders can be placed in the pre-market session from 7 AM through AM Eastern time. The after hours session is from PM through 8 PM Eastern. We, the undersigned, kindly request that you expand your pre-market trading hours to match those offered by Webull and other competitors. At Schwab, orders can be placed in the pre-market session from 7 AM through AM Eastern time. The after hours session is from PM through 8 PM Eastern. Online accounts reach 2 million. TeleBroker adds voice technology. Schwab launches after-hours trading for Nasdaq and select listed stocks, with orders. After-hours: Orders can be placed and are eligible for execution between p.m. and p.m. Post-market trading usually occurs from 4 p.m. to 8 p.m. Eastern time (ET), while the pre-market trading session ends at a.m. ET. Electronic communication. With Schwab, pre-market trade execution begins at am ET, so -6 hours in Hawaii = am. Upvote. Orders can be placed at any time. Pre-Market Trading. Individual investor orders may be executed from a.m. to a.m. ET. Orders can. Hours As TD Bank Cuts Stake Following $B Anti-Money Laundering Fine Provision. Charles Schwab Corporation SCHW shares fell by over 4% in after-hours after. At Schwab, orders can be placed in the pre-market session from 7 AM through AM Eastern time. The after hours session is from PM through 8 PM Eastern. We, the undersigned, kindly request that you expand your pre-market trading hours to match those offered by Webull and other competitors. At Schwab, orders can be placed in the pre-market session from 7 AM through AM Eastern time. The after hours session is from PM through 8 PM Eastern. Online accounts reach 2 million. TeleBroker adds voice technology. Schwab launches after-hours trading for Nasdaq and select listed stocks, with orders. After-hours: Orders can be placed and are eligible for execution between p.m. and p.m. Post-market trading usually occurs from 4 p.m. to 8 p.m. Eastern time (ET), while the pre-market trading session ends at a.m. ET. Electronic communication. With Schwab, pre-market trade execution begins at am ET, so -6 hours in Hawaii = am. Upvote.

Premarket Screener · Currency Tools · After Hours Screener · Upgrades & Downgrades · Mutual Fund Comparison · Mutual Fund Screener · Top 25 Mutual Funds · Where. Pre-market trading occurs before the normal market hours, usually between a.m. and a.m. Eastern Time. During this time, you can place trades on. Schwab offers extended hours trading sessions before and after regular market hours of am - 4 pm ET. Additionally, 24/5 trading of select securities is. Pre-Market: Orders can be placed between p.m. (previous trading day) and a.m. ET and will be eligible for execution between a.m. and a.m. ET. Pre-Market Session: Orders can be entered from p.m. on the previous trading day until a.m. ET. · After-Hours Session: Orders can be entered from During the pre-market session, Schwab clients can trade from a.m. ET to am ET on parktaxi72.ru or Schwab Mobile or round the clock on thinkorswim. Make sure to check Charles Schwab's specific pre-market trading hours to plan your trades accordingly. Step 3: Place a Pre-Market Order. Once you're ready to. Additionally, qualified Schwab account owners can trade select securities 24 hours a day, 5 days a week (excluding market holidays). Such extended hours. Individual investor orders may be executed from a.m. to p.m. ET. Orders can be placed at any time. Pre-Market Trading. Individual investor orders may. Market Data; /; Stocks; /; SCHW; /; Overview. Charles Schwab Corp. U.S.: NYSE. Follow. after hours. $ SCHW. %. Sep 3, p.m. EDT. Pre-Market trade data will be posted from a.m. ET to a.m. ET of the following day. After Hours trades will be posted from p.m. ET to p.m. ET. Pre-market and after-hours limit orders are valid for execution only during that particular electronic trading session (7 a.m. to a.m. ET for pre-market. Investors may trade in the Pre-Market ( a.m. ET) and the After Hours Market ( p.m. ET). Participation from Market Makers and ECNs is strictly. Charles Schwab Corp SCHW:NYSE. EXPORT download chart. WATCHLIST+. RT Quote | Last NASDAQ LS, VOL From CTA | USD. after hours icon After Hours: Last | AM. Most people know the stock market closes at 4 p.m. ET, and some are aware that they can trade in the after-hours session until 8 p.m. However, there are also. If the first and last hours of the trading day seem like the most hectic, it's because they are. · After the opening bell · The surge in volume at the start of. SWTSX After Tax Returns, Pre-Liquidation. Bar chart with 2 data series. View Schwab Funds Monthly Distribution Schedule Performance and Reports. After the dust settles from the opening bell, Trading with Nicole Petallides features Wall Street's best traders, analysts and technicians to break down. Schwab's Extended Hours Trading offering has two components: the Pre Market and the Post Market (After Hours) sessions. Both sessions are independent from the. US Stock Market Hours for Equity and Equity Options ; Eastern Standard Time (EST) - New York, AM, PM ; Central Standard Time (CST) - Chicago, 8.

Best Wordpress Optimized Hosting

A managed WordPress host dedicates its entire operation to WordPress. Everything from caching to Web Application Firewalls (WAFs) is optimized for WordPress. Bluehost has been recommended by WordPress since for a very good reason – there simply isn't a hosting option out there that knows how to optimize. Why Choose Hostek · Flexible Configuration. Our WordPress server experts can help you get exactly the server or servers that you need. · Security Focused. Flywheel is a great managed WordPress host for anyone, which is why we use it for WPKube. The performance is excellent and we like they way they use full-page. The two WordPress hosts which preformed the best all around and in my view are unequaled in the business right now for beginner bloggers and small business are. Hostinger offers some of the best WordPress hosting services for those people keeping tight control over their budgets. It's WordPress optimized, great value. Recommended WordPress Optimized Hosting Providers · Flywheel · Pressable · SiteGround · Cloudways. Experience individual attention and optimized hosting with BigScoots' Managed WordPress Hosting Plans. Boost your site's performance now! In essence, WordPress optimized hosting is when the host provides high-performing back-end code and specifically configured servers for your website. WordPress. A managed WordPress host dedicates its entire operation to WordPress. Everything from caching to Web Application Firewalls (WAFs) is optimized for WordPress. Bluehost has been recommended by WordPress since for a very good reason – there simply isn't a hosting option out there that knows how to optimize. Why Choose Hostek · Flexible Configuration. Our WordPress server experts can help you get exactly the server or servers that you need. · Security Focused. Flywheel is a great managed WordPress host for anyone, which is why we use it for WPKube. The performance is excellent and we like they way they use full-page. The two WordPress hosts which preformed the best all around and in my view are unequaled in the business right now for beginner bloggers and small business are. Hostinger offers some of the best WordPress hosting services for those people keeping tight control over their budgets. It's WordPress optimized, great value. Recommended WordPress Optimized Hosting Providers · Flywheel · Pressable · SiteGround · Cloudways. Experience individual attention and optimized hosting with BigScoots' Managed WordPress Hosting Plans. Boost your site's performance now! In essence, WordPress optimized hosting is when the host provides high-performing back-end code and specifically configured servers for your website. WordPress.

WordPress Hosting optimized for performance with LiteSpeed Web Server & LSCache The best WordPress Hosting should run on servers specifically optimized for. It means that we've carefully crafted our hosting platform and architecture from the ground up, specifically for hosting WordPress websites. This is not to be. Liquid Web WordPress hosting offers a seamless, scalable server configuration. It adjusts to your site's traffic fluctuations without hitting capacity limits. Bluehost is my top choice for starting a new WordPress site, and as a real user, I currently have many sites (parktaxi72.ru, parktaxi72.ru, and others). WPX is the best value Managed WordPress Host. Their servers are nice and fast, you get a staging area, backups, email hosting and while there's no Cpanel, you. If you don't need a lot of technical support and are ready to launch your sites, Dreamhost is a great host. They have one-click installation. One of the key features of optimized WordPress hosting is that it often includes automatic updates, backups, and enhanced security measures. This means you don'. DreamHost is proud to be officially recommended by WordPress. Offering fast, secure Basic and Managed WordPress Hosting options. Get started today. Take the complexity out of website maintenance with a managed WordPress hosting platform that gives you industry-leading speed, security, and support. Managed WordPress hosting is a service that comes with a multitude of features and support, to help websites run efficiently, securely and quickly, leaving the. WordPress hosting is a service designed specifically to optimize the performance and security of websites built on the WordPress content management system –. Best SEO web hosting for WordPress sites — for the overall best WordPress hosting for SEO, go with Kinsta or WP Engine, as they offer the best performance. Bluehost is a major player in the world of WordPress hosting. Launched in , the company now hosts millions of websites worldwide. It means that we've carefully crafted our hosting platform and architecture from the ground up, specifically for hosting WordPress websites. This is not to be. Discover fast, secure, and affordable WordPress hosting with Bluehost, trusted by millions and officially recommended by WordPress since Bluehost is parktaxi72.ru's longest running recommended host and offers the ultimate WordPress platform that powers millions of websites. Their shared hosting. KnownHost simply provides the best managed WordPress option available, all you have to do is sit back and relax! Shared Hosting is the basic/simple hosting of a. Our findings reveal that InMotion Hosting (for budget hosting) and WP Engine or Kinsta (for managed WordPress Hosting) are the clear winners for WordPress. Discover fast, secure, and affordable WordPress hosting with Bluehost, trusted by millions and officially recommended by WordPress since WordPress hosting by Cloudways is the ultimate choice for developers, agencies, and SMBs looking to host their high-performing websites and applications.

Top 10 Bad Credit Credit Cards

First Progress Platinum Prestige Mastercard® Secured Credit Card, Low interest, Poor, limited or no credit, $, $49 ; Petal® 2 “Cash Back, No Fees” Visa®. $ Pros. Free prequalification; Cash back rewards, unlike many Best Credit Cards for Poor Credit · Best Credit Cards for Bad Credit. Share Your Feedback. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. parktaxi72.ru, among others. Other Guides You May Like. Best Credit 10 Best Credit Cards for Poor Credit. +MoreAll Help for Low Credit ScoresBest Credit Cards for Bad CreditBest credit cards, 10 cards is still well above the national average of four. How Do You Select an Unsecured Card for Good Credit? Final Thoughts. Best Unsecured Credit Cards- Credit Cards for Poor or Bad Credit. Here are the five best. The best credit cards for bad credit are secured cards with no annual fee. That's true for everyone with poor credit, except people who need a modest emergency. Do you have bad credit? Then, your search is over. These credit cards for bad credit are designed for lower credit scores. Find the right card now! But if you have bad or damaged credit, you may want to focus on cards that offer no or low fees, competitive purchase APRs, and credit-score requirements that. First Progress Platinum Prestige Mastercard® Secured Credit Card, Low interest, Poor, limited or no credit, $, $49 ; Petal® 2 “Cash Back, No Fees” Visa®. $ Pros. Free prequalification; Cash back rewards, unlike many Best Credit Cards for Poor Credit · Best Credit Cards for Bad Credit. Share Your Feedback. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. parktaxi72.ru, among others. Other Guides You May Like. Best Credit 10 Best Credit Cards for Poor Credit. +MoreAll Help for Low Credit ScoresBest Credit Cards for Bad CreditBest credit cards, 10 cards is still well above the national average of four. How Do You Select an Unsecured Card for Good Credit? Final Thoughts. Best Unsecured Credit Cards- Credit Cards for Poor or Bad Credit. Here are the five best. The best credit cards for bad credit are secured cards with no annual fee. That's true for everyone with poor credit, except people who need a modest emergency. Do you have bad credit? Then, your search is over. These credit cards for bad credit are designed for lower credit scores. Find the right card now! But if you have bad or damaged credit, you may want to focus on cards that offer no or low fees, competitive purchase APRs, and credit-score requirements that.

Credit Cards with No Annual Fee · Low Intro APR Balance Transfer Credit Cards · Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Cards. Types of credit cards for bad credit. Credit cards for poor credit are designed to have fewer frills and more opportunities to start building or improving your. Explore Capital One Platinum Secured card benefits · Account Alerts. Set up personalized email or text reminders to help you stay on top of your account. If you have bad credit or limited credit history and are making on-time payments and not maxing out the card on a regular basis, having a business credit card. Depending on why you have bad or poor credit in the first place, it could take some time to move into a new credit score range (such as fair or good). However. Whether you're dealing with the negative effects of bad credit, or simply don't have much of a credit history to speak of, applying for a secured credit card. Auto lenders view low credit as a sign of risk, so an applicant with poor or fair credit will pay more in interest to borrow a car loan. If your FICO® Score is. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. Overview of the Best Business Credit Cards for Bad Credit in ; First Tech Platinum Secured Mastercard sample. First Tech Platinum Secured Mastercard®. Low. Most credit scores that lenders use in the United States range from to In general, a FICO® Score below is bad (or poor). The OpenSky® Plus Secured Visa® Credit Card is the easiest credit card to get because you can qualify even with bad credit as there's no credit check for new. Turning Around Bad Credit. Having a low credit score tells lenders and other businesses that you've had some problems managing your personal finances. Maybe you. Typically, a “bad” or poor credit score is anything under the range. For example, Vantage considers a credit score between and poor, while FICO. Credit Cards for Poor Credit. We know that it can be frustrating trying to apply for a new credit card when you have poor credit. Got a poor credit rating? A credit card for bad credit could help you build up your score. Here's what you need to know. How do I know if Discover is the best secured credit card for me? If you Denied for credit cards or loans due to poor credit? Learn what secured. Choosing a credit card for bad credit If you've a poor credit history, using a credit card to show you can repay on time each month can help rebuild your. Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits. 16 votes, 16 comments. Depression got in the way and I stopped caring tbh, I was doing great at when I let some cards rack up.

1 2 3 4 5